The AA02 ‘Dormant company accounts’ is a form designed for dormant limited companies to submit accounts. The companies that should use the AA02 should be dormant limited companies that have never traded to the companies house before. The only transactions these companies should have in their accounting records should be the subscriber share.

Related forms:

The related accounting forms are AA01 and AA03. AA01 is used to change an accounting reference date relating a current or previous accounting period. AA03 form could be used to give notice of the removal of an auditor.

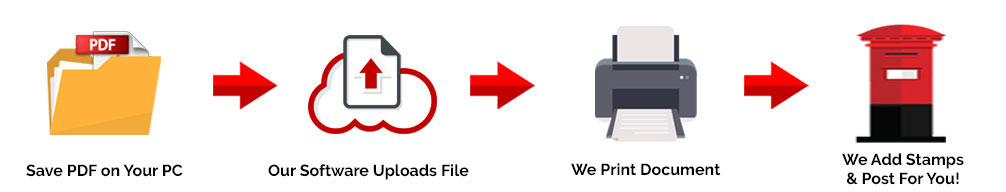

Easily Get a Copy of this Paper Form…

Form Charge and processing time:

The form is free of charge but must be completed in a 9 months time frame after the end of the financial year; Failure to do so could result in a £100 penalty. The process should take 2-3 weeks.

Can

- Can only be filed by directors responsible for filing accounts. Forms must also comply with requirements!

- Can use if dormant company and not a subsidiary.

- Can use if the accounts are prepared in line with the provisions

applicable to companies subject to the small companies’ regime - Can use web filing service to file dormant company accounts online

Can’t

- This form cannot be used if your company is a charity or has no shares.

- This form cannot be used if the accounts prepared are in line with International Accounting Standards (IAS)

- This form cannot be used if a companies only transaction is not the issue of the subscriber shares.

- This form cannot be used for preparation of full accounts for members. Abbreviated dormant

accounts only!

Address:

Please use the link above to access company house addresses to which you are able to send off forms

|

|

|

Important Notes

-

- Forms not completed correctly with missing information will be returned.

- Company address will be available for the public, so make sure to provide an actual physical address. Take note that a PO Box number will not be accepted (unless it is part of a full address). It also cannot be a DX or LP (Legal Post in Scotland) number.

- The form must be completed in typescript or in BOLD black capitals. All fields are mandatory to fill out unless specified or indicated by *

- When filling out the form, make sure that shares are fully paid, partly paid or unpaid. Show this as “Cash at Bank and in hand” and any unpaid element should be titled as “Called up share capital not paid”.

- If dormant company has acted as an agent, it must be stated in section 3.

- Make sure to enter the date of approval of the accounts in section 4.

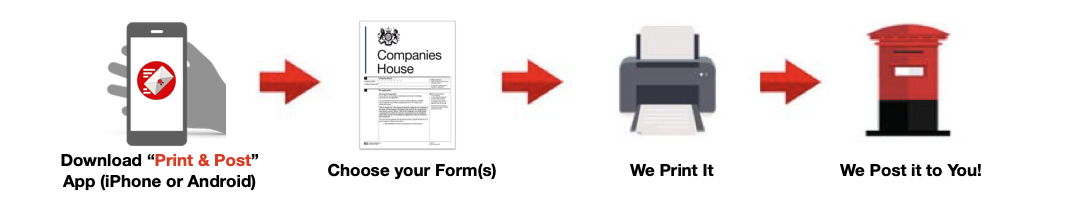

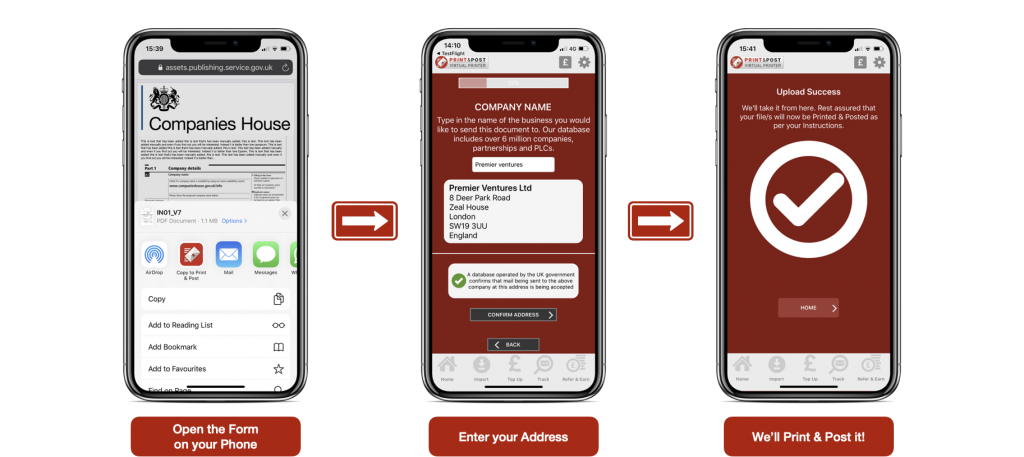

Download the Print & Post app for FREE Now…

Disclaimer: While every effort has been taken to ensure all of the information within this article is accurate and beneficial, please do consider that this was written in good will and is not professional or legal advice. We cannot be held liable should you incur any financial or other form of loss by following the above unofficial guidance.

- Passport Size Photo Maker and Background Eraser - December 8, 2021

- DV LOTTERY PHOTO TOOL REVIEW - December 8, 2021

- UK PASSPORT PHOTO REVIEW - December 8, 2021