The Annual Return of a company is a definitive snapshot of the company’s current data, and it acts as a review for incorporated corporations to correct and validate that the information shown on Companies House documents is compliant with their own statutory data.

Any UK company and limited liability partnership is required by law to plan and apply an annual return form to Companies House once a year, covering the period from the first anniversary date of original incorporation to the current year.

The Importance of an Annual Return Companies and Limited Liability Partnerships in the United Kingdom have 28 days from the anniversary of their establishment (and annually thereafter) to file an annual return. Although Companies House sends postal notices to each company’s registered office about a month before the anniversary, it’s always a good idea to have a private alarm system in place to ensure that the papers are filed on time.

Failure to file an Annual Return would potentially result in the company’s breakup, as well as penalties of up to £5000. And if the corporation is later administratively restored, all Annual Returns that were due after that period must be brought up to date.

In most cases, all paper and online AR01 forms are available for submitting an Annual Return. The paper version of this form would not be approved if a company has registered for Companies House Web filing and then joined the Proof Scheme.

Related Forms To AR01

Any previous adjustments on the Registered office address must be reported to Companies House by sending the supporting AD01 form.

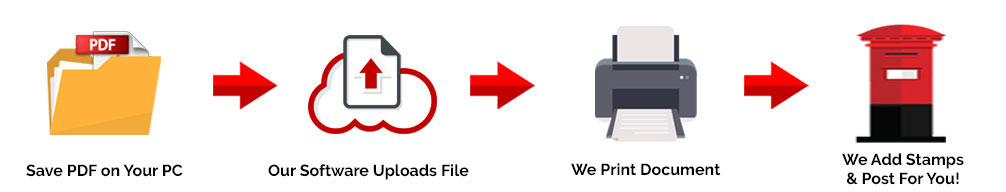

Easily Get a Copy of this Paper Form…

AR01 Form Charge

The paper edition of the Annual Return will set you back £30, while the ‘Web Filing’ service will set you back £15.

Companies House has more information on the electronic filing program.

AR01 Processing Time

There is no precise timeline for Companies House processing this form however postal applications usually take 2-3 weeks for it to be registered on the public database

CAN AND CANT’S ON FORM AR01

CAN

- This form may be used to verify that the business details are correct as the date of this return. An Annual Return must be filed at least once a year.

CAN’T

- This form cannot be used to notify Companies House for any changes to the registered office address, company officers, company type, or details pertaining to the company registry.

Address for AR01 Form

You may send this form to any Companies House address, but we recommend that you send it to the address found in the form AR01.

AR01 – 2015 annual return – Expanded

Any limited partnership in the United Kingdom is required to file an Annual Return with Companies House which is usually done on the anniversary of incorporation. The Registrar of Companies collects current information about the firm, its officers, and the breakdown of share capital through Form AR01.

The following is a list of the key details captured by the AR01 form:

- Name of the company, its registration number, and its registered address.

- If applicable, a different address where the organization holds its records.

- The fictitious return date (the date to which the return is made up to).

- The company’s core corporate operations (identified by SIC codes).

- A capital statement (if the company has shares).

- Whether or not the company’s stock has been traded on the stock exchange.

- A list of the firm’s owners (including all details of all transfers that have taken place over the past 12 months).

- Whether or not the business is private or public.

- Information about the company secretary (if applicable).

- Information about the company’s director (name, address, etc.)

What is the procedure for submitting your Annual Return?

The director(s) of the limited company director and the company secretary (if there is one appointed) are the ones responsible for completing and sending the Annual Return to Companies House within 28 days of the company’s incorporation anniversary (or on the made up date of the last return). Failure of to submit your Return so is a felony offense for which you can be charged.

See list below for step by step guide:

Name and phone number of the company: Make sure the name and business number is just the same as they are on the registration. The Companies House Web Check Service can be used to check these.

Principal Business Activity and SIC Code: This must be defined since SIC codes are used by Companies House to define the business’s main area(s) of service. The applicable SIC code would actually be the dormant code if the corporation in question was dormant for the year of which the Annual Return AR01 form was made up to.

Company Type: This section will discuss the company’s legal status, such as whether it is a private limited company or a public limited company.

The Registered office address: The registered office address is the company’s legal legislative residence, and it must be filled out fully. Any previous adjustments must be reported to Companies House by sending the supporting AD01 form.

SAIL (Single Alternative Inspection Location) address: This is a distinct and exclusive address where the company’s regulatory documents are held. The AR01 form’s SAIL address section is only for businesses that have chosen to hold their business documents anywhere other than their stated registered office address.

Secretary/ Corporate Secretary details: The information you have here must match what you have on file at Companies House. This segment must be updated with any new information. A supporting form must be attached to your return. Formers names that have been used for business purposes must also be provided here but unless it’s for business used, married women do not need to give former names.

Secretary Service Address/Corporate Service Address: Provide the address for the Company Secretary. It may be a business or a home address, but it must be the address where the company secretary first registered with the company when it was founded. Please have a supporting form and apply it to your return if there are any updates.

For the Location of Registry: If your business is not based in the European Economic Area, this section would ask you to mention the country in which it is registered, as well as the registration number.

Statement of Capital: In this section, you must record the number of shareholders and shares owned by the firm. This portion is not needed if you are a non-profit organization with no stockholders.

Two sections are found here: the F1 which is for shares denominated in British pounds, and F2 which is for shares denominated in other currencies.

You can have shares in both currencies by submitting the necessary documents. You will need to complete all parts in this case.

Please provide the following information:

- The number of shares and their net nominal value (how much the shares are worth in £ compounded by the amount issued)

- The class of your share

- The amount charged to each share

- The sum unpaid

Statement of Capital (Voting Rights): In this clause, you must specify the class of your share, for example, A, B, or C, as well as the voting rights associated with each share.

Shareholders’ List: If your business has stock, fill out the sections below; if it doesn’t, skip ahead to the section that needs you to sign. Note that the number of shares allotted to each shareholder must equal the total share capital; no shares can be left unallocated.

Traded Public Company: This box should be checked if the company has traded stock on a controlled exchange at some point this year. Leave this box blank if it has been dead for this long.

Past and Present Shareholders’ List: Before filing your annual report for the first time, you must include the entire history of your company’s shareholders up to that point; after that, you would only need to include the entire history of your company’s shareholders per third return.

This section now requires you to have the following information:

- The company’s shareholders’ information

- The number of stock they own

- Their share class

- Company category

(Make sure to tick box that relates to your companies type of shares).

|

|

|

Companies House has right to return forms that have been filled out incorrectly or that are missing details. So make sure to check the following:

- The corporate name and number are identical to those on the official register.

- You’ve finished your main market practice.

- You have not updated the registered office address using this form.

- You haven’t used this form to update the secretary or director’s information.

- In Part 3, make sure you gave the complete date of birth for each particular director.

- You’ve finished the capital statement in its entirety (if applicable).

- You’ve completed the form and signed it.

- The right fee has been enclosed.

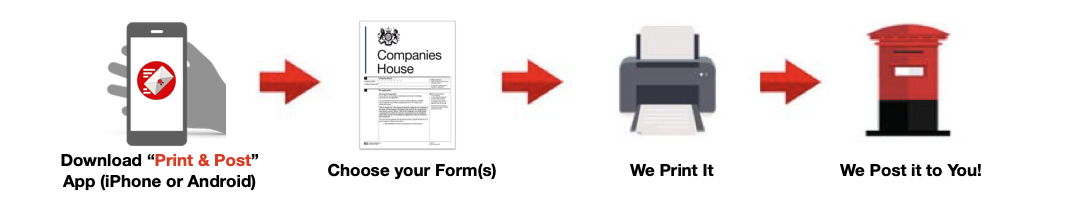

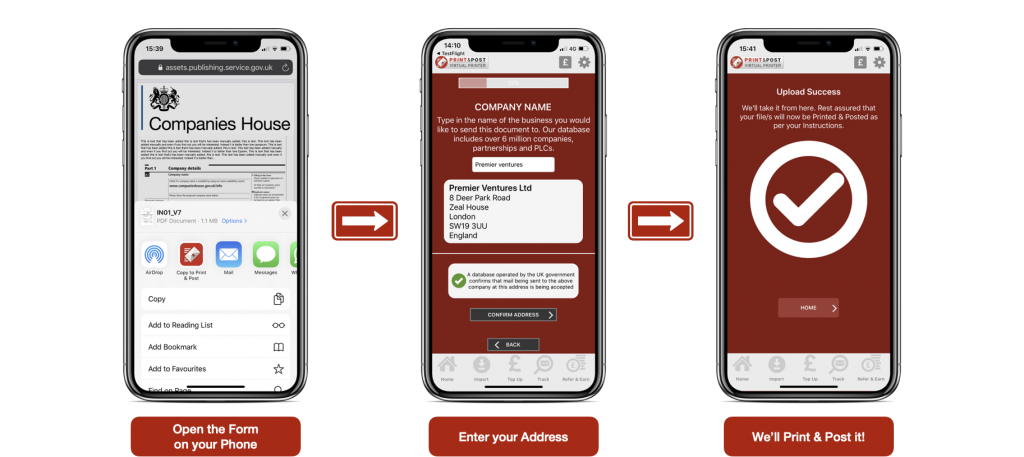

Download the Print & Post App to Easily have this form Posted to you…

Download the Print & Post app for FREE Now…

- Passport Size Photo Maker and Background Eraser - December 8, 2021

- DV LOTTERY PHOTO TOOL REVIEW - December 8, 2021

- UK PASSPORT PHOTO REVIEW - December 8, 2021