What are the reasons for re-registration?

Private companies usually re-register as public companies for them to be able to market their shares publicly and to request acceptance on the stock market.

For example, their reasons may include the following:

- for financial growth and development

- establishing the company’s market value

- boosting the profile of the company

- establishing a market for the shares of the company

- improving the business’ standing with suppliers and consumers

Some firms believe re-registering to get the ‘plc’ suffix improves credibility. However, this is less common, as the costs of re-registration, and the additional administrative workload for public corporations outweigh the potential benefits of obtaining a ‘plc’ name.

Related Forms

If you are trying to appoint a new secretary, you will need to use form AP03 and AP04 if it is a corporate secretary.

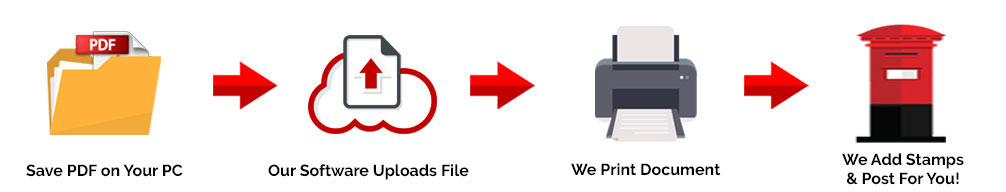

Easily Get a Copy of this Paper Form…

RR01 Form Charge

£20 for re-registration request.

Processing Time

The processing time for this form is usually 2-3 weeks.

CAN

- Private companies can use this form to apply for re-registration as a public company.

CAN’T

- Private companies cannot use this form to apply for re-registration as a private unlimited company.

Address for RR01 Form

You can send form RR01 to any Companies House address.

RR01- Re-register a private limited company to a public limited company – Expanded

For a private limited company to re-register as a public limited company, the criteria is:

- It passes a special resolution

- It meets prescribed conditions;

- An application for re-registration, along with other required documents.

The legal papers required in this process are:

- One copy of the company’s special resolution to re-register as a public limited company

- A copy of the revised association articles (printed)

- A copy of a balance sheet is compiled by the auditors of the firm within seven months of the date of request.

- Written declaration by the auditor according to paragraph 92(1)(c) of the Company Act 2006.

- A copy of an unqualified report from the auditor

- Assessment report on all shares paid in their entirety or part excluding cash after the date of the balance sheet

- If no business secretary has been named, a declaration of the company secretary suggested by that company must be completed according to Section 95 of the Companies Act 2006.

- The RR01 form must be signed by the director or company secretary

Issuance of certificate

Once Companies House accepts the request for a private limited company to re-register as a public limited company, Companies House grants a certificate that represents the registered status of the company.

Once RR01 is issued:

- The corporation becomes a public enterprise

- Changes in the names and articles of the company will take effect

- The request, where it contained a declaration of the proposed secretary, is considered to have been appointed as a secretary or joint secretary of the corporations in the statement.

|

|

|

Important Notes

If there are missing or incorrect details, Companies House has the right to return forms therefore is important to check:

- The name and number of the corporation correspond to the details in the public register.

- Provide the new company name in section A2.

- Include the supporting documentation as required in section A2.

- The address of the company secretary must be a physical address.

- There is a signature on the form

- You have enclosed the £20

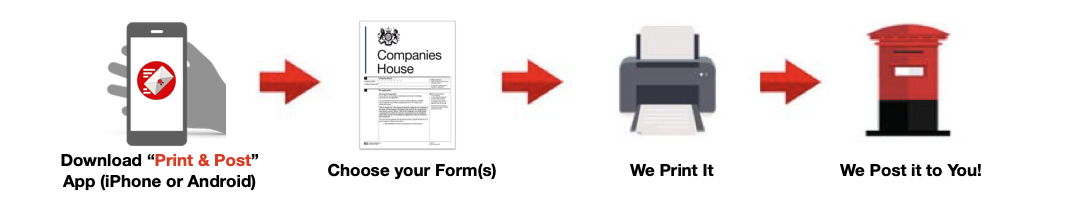

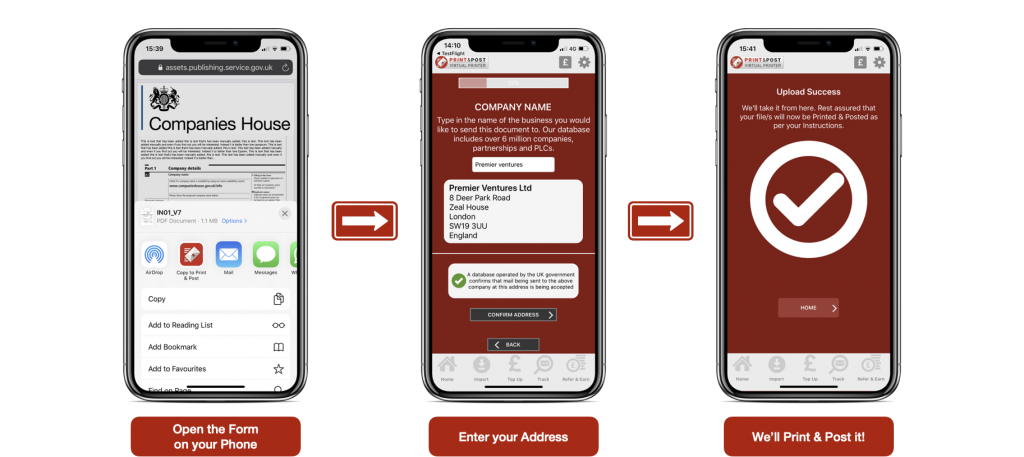

Download the Print & Post App to Easily have this form Posted to you…

Download the Print & Post app for FREE Now…

- Passport Size Photo Maker and Background Eraser - December 8, 2021

- DV LOTTERY PHOTO TOOL REVIEW - December 8, 2021

- UK PASSPORT PHOTO REVIEW - December 8, 2021