What is share capital?

The money a company earns by selling common or preferred stock is known as share capital. With new stock offerings, a company’s share capital or equity funding will shift over time. It refers to the net amount earned by the group by equity transactions.

Why should a company reduce share capital?

To be able to pay the shareholders a dividend

A company will not need to pay dividends if it has accrued losses that have impaired the account balance sheet.

When you have accrued losses, the net result of a capital cut is that the losses are effectively eliminated and the business returned to profits.

To be able to pay cash back to shareholders

The company can give back the money to the shareholders if it has collected funds for a project that did not go as planned.

Saving the shares

If a company may be interested in repurchasing its shares (e.g. if an individual wishes to withdraw) it cannot do so until it has distributive reserves or had issued new shares. If the company does not have either distributive reserves or does not issue additional shares, it can reduce capital and pay in cash to cancel the shares.

To be able to transfer assets to the shareholders

Instead of paying in cash, a company can instead transfer non-cash assets like a property to the shareholders and then cancel an equal share value.

As part of a company reorganisation like a de-merger

A capital reduction is sometimes used as part of a merger or a de-merger where there is a need to split out trading activities into separate companies.

Related Forms

AP03 form is to be submitted to Companies House to notify them of an appointment of a person as a company secretary. If you are trying to appoint a corporate secretary, you will need to use and complete for AP04 form, instead.

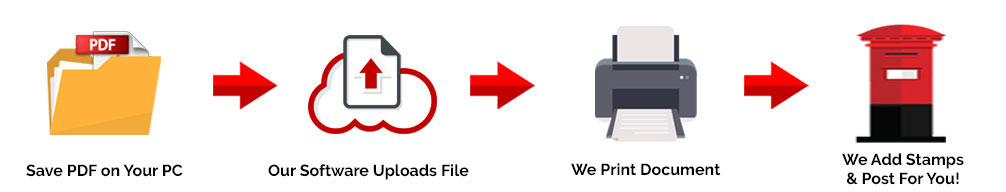

Easily Get a Copy of this Paper Form…

SH19 Form Charge

A standard filing fee cost £10 and £50 for same day service.

Processing Time

There is no precise timeline for Companies House processing this form however postal applications usually take 3-4 weeks for it to be completed.

CANS AND CANT’S FOR FORM SH19

CAN

- This form can be used as a statement of capital for a private limited company that planning to reduce its share capital that is supported with solvency statement or a private or public limited company that is reducing its capital based on a court order.

CAN’T

- This form cannot be used to complete a capital statement for a company that is changing its status from unlimited to limited.

Address for SH19 Form

SH19 form is to be submitted to The Registrar of Companies, Companies House, Crown Way, Cardiff, Wales and CF 14 3UZ if your business is registered in Wales or England. For businesses registered in Northern Ireland or Scotland, see relevant address on gov.uk.

SH19 – Statement of capital when reducing capital in a company – Expanded

Capital reduction usually happens when a company reduces the value of its capital share.

The company can reduce its share capital in a number of ways, including extinguishing or reducing the debt on all of its shares in respect of unpaid share capital, cancelling any paid-up share capital that is lost or not represented by available assets (known as a loss reduction), and repaying any paid-up share capital in excess of the company’s needs.

A company’s equity capital can be reduced by lowering the number of shares in question, the nominal value of those shares, or the sum paid out on those shares.

Companies would want to reduce its share capital for a variety of reasons, including the ability to create distributive reserves in order to pay a dividend or buy back or redeem its own shares; to reduce or eliminate accumulated realized losses in order to make future distributions; to return surplus capital to shareholders; or to distribute non-cash assets to shareholders (usually in the context of a de-merger).

A share capital of a private may be reduced by a special vote of the owners, which must be approved by the court or by a solvency declaration signed by all of the directors.

For reduction of capital in the company, you will need to complete and submit form SH19. The following information are needed:

- Company number

- Complete company name

- Details about the shares that the company wants in section 2.

- Prescribe particulars with a response that is usually “one share is one vote each having dividend rights provided that there aren’t rights attached to the shares on winding up, redemption rights, etc.

- Enter your details and sign in box four.

To complete this capital reduction, the directors must also ensure that the following are met:

- The Articles of Association do not preclude reductions in share capital – they can be modified by a special resolution;

- After the reductions of share capital, there should be at least one non-redeemable share would be in question.

When the company is a public limited company, a special resolution confirmed by the court must be passed to reduce the equity value. For private limited company, a special resolution backed by a solvency declaration issued by the directors, will complete the share capital reduction.

The following should be completed in any case:

- Board consent to propose a reduction of share capital

- A special resolution authorizing the reduction of share capital.

If the reduction is to be confirmed by the court, the directors must then need to seek the necessary court order.

If the reduction is to be backed with a solvency statement, directors will need to submit a solvency statement in accordance to the Companies Act 2006.

|

|

|

Important Notes

Companies House has the right to return forms that have been filled out incorrectly or that have missing details. So make sure to check the following:

- The name and number of the corporation match what is on the public register.

- The relevant sections of the capital statement have been completed.

- The form has been signed.

- The right fee has been enclosed.

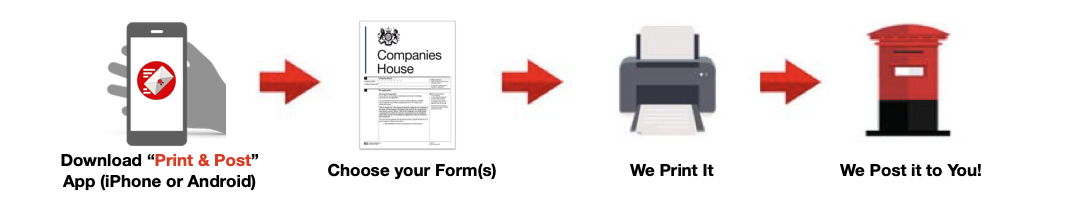

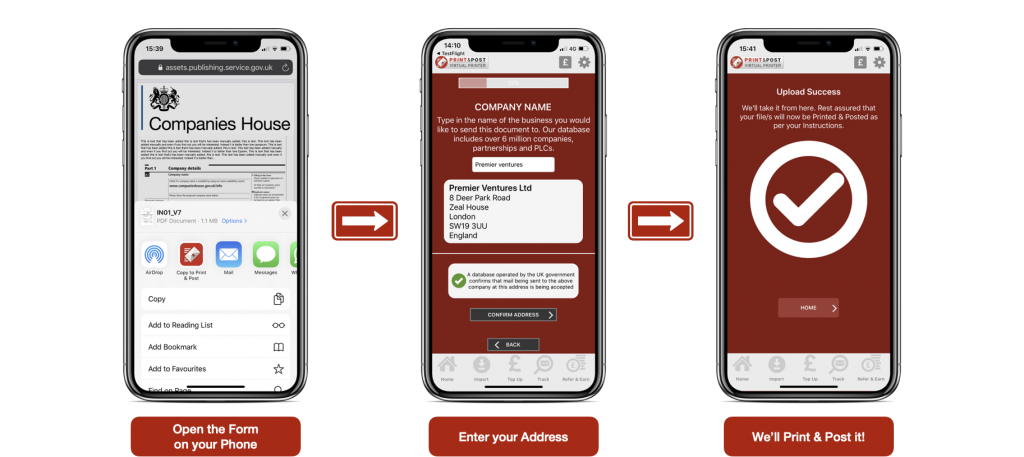

Download the Print & Post App to Easily have this form Posted to you…

Download the Print & Post app for FREE Now…

- Passport Size Photo Maker and Background Eraser - December 8, 2021

- DV LOTTERY PHOTO TOOL REVIEW - December 8, 2021

- UK PASSPORT PHOTO REVIEW - December 8, 2021