The term “strike off a company” refers to the process of deleting all of the information on your limited company from the Companies House registry.

If you want to strike off your company, you’ll need to fill out the DS01 ; also called as the company strike-off form. It’s important to remember that such a financially sound organisation will opt for voluntary strike off. If you owe creditors money, you must repay them before filing the DS01 form.

Any business that is undergoing a structured insolvency proceeding is ineligible.

Related Forms

–

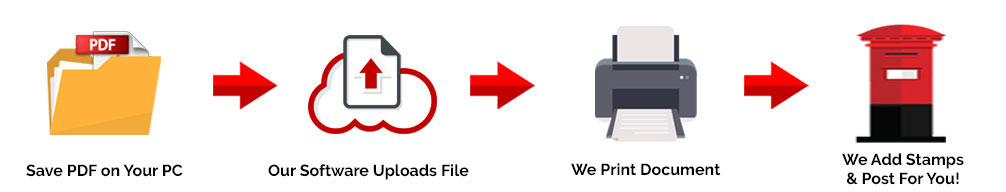

Easily Get a Copy of this Paper Form…

DS01 Form Charge

To apply to strike off a company from the Companies House registry will costs £8 for an online application and £10 if you apply by mail.

DS01 Processing Time

3 months.

CAN AND CANT’S FOR FORM DS01

CAN

- This form can be used to strike off a company from the Companies House register.

CAN’T

- You cannot submit a paper form DS01 if you can apply online.

Other Forms

Address for DS01 Form

The following are the addresses for Companies House in each of the cities:

- English and Welsh companies – Companies House, Crown Way, Cardiff CF14 3UZ;

- Scottish companies – Companies House, 4th Floor Edinburgh Quay 2, 139 Fountainbridge, Edinburgh EH3 9FF;

- Northern Irish companies – Companies House, 2nd Floor The Linenhall, 32-38 Linenhall Street, Belfast BT2 8BG.

DS01 – Strike off a company from the register – Expanded

How can you strike off a company?

To strike off your company from the Companies House registry, you must file a DS01 form, as previously stated. Before you start the company strike off procedure, your company must not be doing the following for three months:

- Buying and selling

- Any assets or rights owned by the company was sold

- The corporate name has been changed

- Initiated the systematic insolvency mechanism

A company that is unable to meet its obligations, has a pending winding up petition, or has reached an agreement with creditors that their company is not eligible to strike off voluntarily (CVA etc.).

After filing a company strike off form, the company can no longer trade, sell company properties, or engage in all other corporate practices. If the company is found to be responsible for all of the aforementioned, you may face serious consequences.

A directorship ban of up to 15 years is one of the fines that can be imposed.

If you don’t share the company’s properties until dissolving them, they’ll be returned to the crown in a process known as “bona vacantia.”

As a result, it’s important to wrap up all loose ends before the strike off.

If you try to reclaim those properties after the company is dissolved, you’d have to return the company to Companies House, which can be a time-consuming operation.

You also need to know that when the business name has been deleted from the Companies House register, it will be open for use by anyone.

DS01 form submission

Directors can opt to voluntarily strike off their business for a variety of reasons:

- Restructuring

- Business challenges

- Lack of growth

- Retirement

- Business idea wasn’t successful

It’s also worth considering selling the firm as a going concern – but only if the current operation is financially sustainable.

Companies House charges a £10 strike-off fee after filing an application.

The check must be made payable to Companies House and not submitted from the business’s account.

If this is the case, you might be considered to be trading which will potentially break the voluntary procedure.

In general, it takes at least three months for a corporation to be struck down, ensuring no issues arise and all information is right.

Depending on your company’s location, a note will be issued in the London, Edinburgh, or Belfast Gazette.

This will give all involved parties the opportunity to object to the company’s strike off.

If this is the case, the operation will be postponed.

So, what’s next?

You have seven days after filing the DS01 form to notify all relevant parties:

- Employees

- Shareholders

- Creditors

- The directors who did not sign the form

- The employee pension fund’s manager or trustee

If you have business loans, you won’t be able to complete the optional strike-off procedure until they’re paid off.

Companies House will not notify you which creditors have raised objections, but you must be mindful of all cash flow problems.

If HMRC has not been informed of the strike of protocol in advance, the applications will be rejected.

The Companies House website made it clear that this is not an option to file bankruptcy.

So, when applying, you must follow the proper procedures, and those who do not will penalize.

If your company has been taken off the registry and you still have debts that were proven; the creditor can petition to have your company reinstated. If they are successful, they may begin debt collection proceedings, which could include a winding up petition. Similarly, HMRC will also try to recoup any money you owe them. With the tax arrears backdated, you may face further fines.

If no complaints are received after Companies House receives the DS01 form and the note is published in the gazette, the company will be taken from the register three months from the date of the notice.

|

|

|

Important Notes

Companies House returns several DS01 forms because some of the information provided was found to be inaccurate, which is usually the cause of delay. So make sure to check your form before submitting it.

The most popular reasons why Companies House rejects the paper DS01 form are mentioned below.

- The signatory’s name is not printed on the document. Each person signing the form must have their name clearly printed in section 3’s ‘Name’ area.

- The date of signature is incomplete.Each signature in section 3 must be followed by a date in the ‘Signature Date’ area.

- The majority of the directors have not signed the form. So, if the company has two directors, for example, both must sign and If the company has three directors, at least two of them must sign.

- The £10 fee is not included in the price. A charge of £10 must be included with the form and made payable to Companies House (by cheque or postal order). Cheques should not be drawn on the company applying for strike-account.

- Incorrect or company name and number. Both names and numbers must fit those on the Companies House register.

Other Reasons why your application will be rejected:

- A creditor who opposes a strike-off for unpaid debts

- Evidence that you were in business or changed your corporate name in the three months prior to filing the application.

- The decision was not communicated to interested parties.

- The company is currently facing legal action.

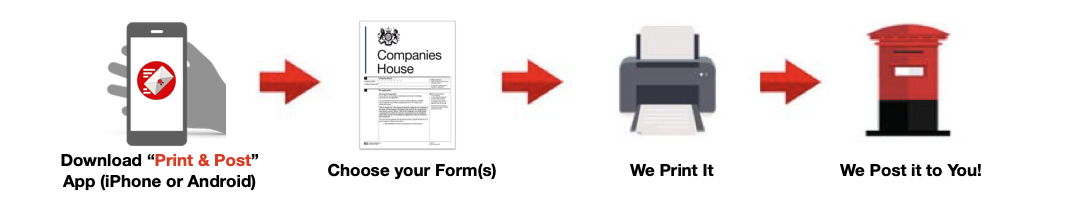

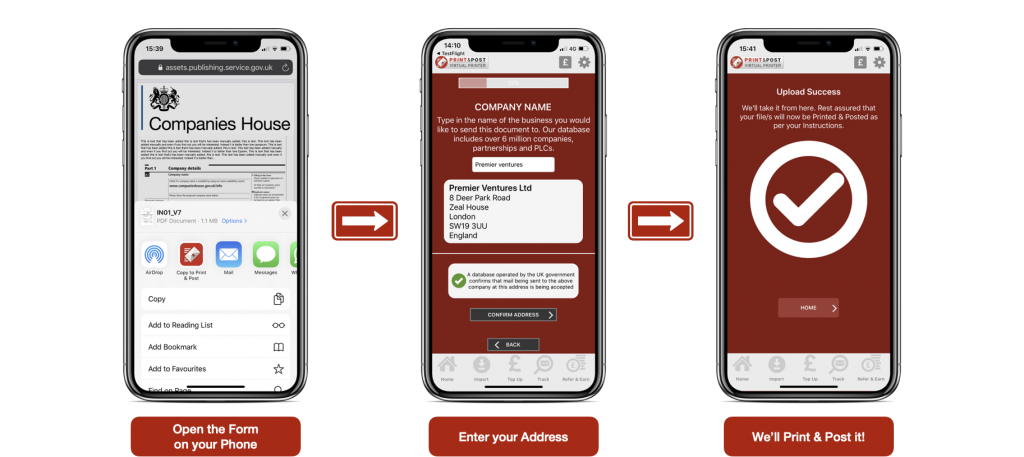

Download the Print & Post App to Easily have this form Posted to you…

Download the Print & Post app for FREE Now…

- Passport Size Photo Maker and Background Eraser - December 8, 2021

- DV LOTTERY PHOTO TOOL REVIEW - December 8, 2021

- UK PASSPORT PHOTO REVIEW - December 8, 2021