Return of Allotment of Shares

The method of adding new shares to a company is known as “Return of Allotment of Shares.”

A company founded with one share, for example, will fill out a “Return of Allotment of Shares” (also known as the SH01 form) to increase the number of shares to a new sum. Until the confirmation statement is filed with Companies House, the name of the shareholder who will obtain these shares is not revealed.

When to submit SH01 form

Within a month of the shares being allotted, a SH01 Form must be filed with Companies House. This means that Companies House has an accurate record of your shareholder structure and how your company’s ownership is divided by shares at all times.

Related Forms To Form SH01

If the subscriber shares issued by the company at incorporation are included in the application to register a company, there’s no need to file form SH01, instead, you will need to file form IN01.

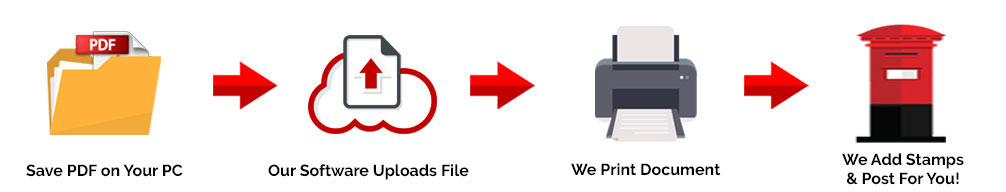

Easily Get a Copy of this Paper Form…

CH01 Form Charge

You do not need to send any payment to Companies House alongside the SH01 form, they will process it for free.

Processing Time

There is no precise timeline for Companies House processing this form however it should be processed within 2-3 weeks.

CAN AND CANT’S FOR FORM SH01

CAN

- You can use this form to notify Companies House of shares that have been allocated after incorporation.

CAN’T

- You may not use this form to notify Companies House about the subscribers of shares taken when the firm is established or to assign an unlimited company to a new class of shares.

Other Forms

- RR01- Re-register a private limited company to a public limited company Downloadable PDF Form – Print & Post

- SH19 – Statement of capital when reducing capital in a company Downloadable PDF Form – Print & Post

- AD02 – Register a single alternative inspection location Downloadable PDF Form – Print & Post

- AR01 – 2015 annual return Downloadable PDF Form – Print & Post

- TM02 – Termination of appointment of Company Secretary Downloadable PDF Form – Print & Post

- SH01 Return of allotment of shares Downloadable PDF Forms – Print & Post

- CERTNM – Change in company name Downloadable PDF Forms – Print & Post

- MR01 Register Particulars of a Charge Downloadable PDF Form – Print & Post

- PSC04 – Change the details of your person with significant control Downloadable PDF Form – Print & Post

- DS01 – Strike off a company from the register Downloadable PDF Form – Print & Post

- TM01 – Termination of appointment of director Downloadable PDF Form – Print & Post

- AA02- Dormant company accounts

- AA02 -Dormant Company Accounts Downloadable PDF Form – Print & Post

- AD01- Change a company’s registered office address Downloadable PDF Form – Print & Post

- AP01-Appointment of Director’s Details Downloadable PDF Form – Print & Post

- CH04 – Change of Corporate Secretary’s Details Downloadable PDF Form – Print & Post

- CH03 – Change the details of a secretary Downloadable PDF Form – Print & Post

- CH02 – Change of Corporate Director’s Details Downloadable PDF Form – Print & Post

- CH01 – Change of Director’s Details Downloadable PDF Form – Print & Post

Address for SH01 Form

It depends on whether your business in England, Wales or Scotland or Northern Ireland in regards to where you need to send the form too. The address for each is included on the right hand side of the form in question.

SH01 Return of allotment of shares – Expanded

What are the information needed to complete SH01 form? It’s a good idea to gather all of the details you’ll need to complete the form before you begin. In general, the SH01 form requires:

- Name of the company

- The Company registration number

- Types of share allotted (ordinary/preference)

- Allotment date

- Currency used for the shares (Sterling/Euro/Dollar)

- Number of shares

- Share’s nominal value

- Unpaid per share or amounts paid

- An updated capital statement

- Description of the consideration if not cash

You do not have to include the details of the new shareholders in the form SH01, just the shares. When you make a clarification statement the next time, the shareholder information is included. If you want new shareholders to be registered with Companies House earlier, you can send an early confirmation statement.

When completing Form SH01, the following are important:

- You enter, in particular, the face value of each share and the amount paid per share and the unpaid amount per share, the correct amounts in Section 3 (shares assigned), since these include any share premium.

- You enter the sums correctly, particularly the aggregate nominal value, into the statement of capital section. This section is explained in our article on the statement of capital.

- You can report series of allocations to Companies House in the same SH01 form or in a number of different forms. If it is filed on the same form SH01 within a month of the previous allocation and the capital statement included should reflect the position of the company following its most recent allocation.. Alternatively, if you submit a series of forms, you should attempt to submit them in order to issue the allocations. Some people even choose to wait until Companies House accepts one form before submitting the next form.

- You will have to pay particular attention if the company issues new shares in whole or in part for cash purposes, e.g. owner of a property holding shares in the company and owner of a property.

You should then show to what extent the company has treated the shares as paid-up on the SH01 form and include a brief description of the non-cash payment of the shares.

In addition to the SH01 form, don’t forget to update your Members Register and register allocations for the newly issued shares.

|

|

|

Important Notes

Companies House has right to return forms that have been filled out incorrectly or that are missing details. So make sure to check the following:

- Make sure that the company name and number matches the information held on the public Register.

- Make sure that you have shown the date(s) of allotment in section 2.

- Make sure that you have completed the appropriate share details in section 3.

- Make sure that you have completed the relevant sections of the statement of capital.

- Make sure that you have signed form SH01.

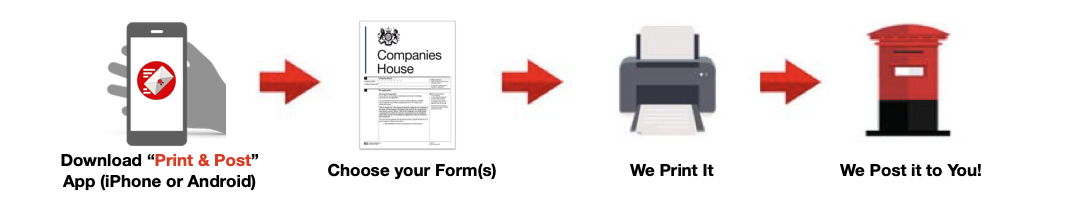

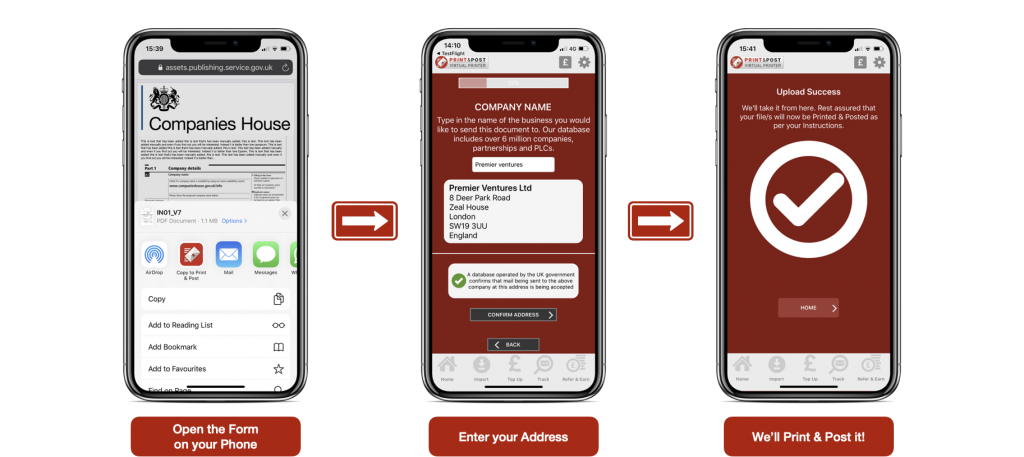

Download the Print & Post App to Easily have this form Posted to you…

Download the Print & Post app for FREE Now…

- Passport Size Photo Maker and Background Eraser - December 8, 2021

- DV LOTTERY PHOTO TOOL REVIEW - December 8, 2021

- UK PASSPORT PHOTO REVIEW - December 8, 2021